Full Professor, Political Science, Sciences Po (CEE, MaxPo & LIEPP)

Tax cooperation seems to be more difficult to achieve through multilateralism than any other economic issue, despite growing consensus about the detrimental effects of corporate tax competition for both market integration and economic inequalities. Repeated attempts to harmonize corporate taxation have gained momentum since the financial crisis, with important proposals made by the OECD and the European Union. Yet failure to implement or even reach agreement on these proposals shows the need for leadership of the G7 in order to address the concerns of those countries that stand to lose most from corporate tax harmonization.

Detrimental effects

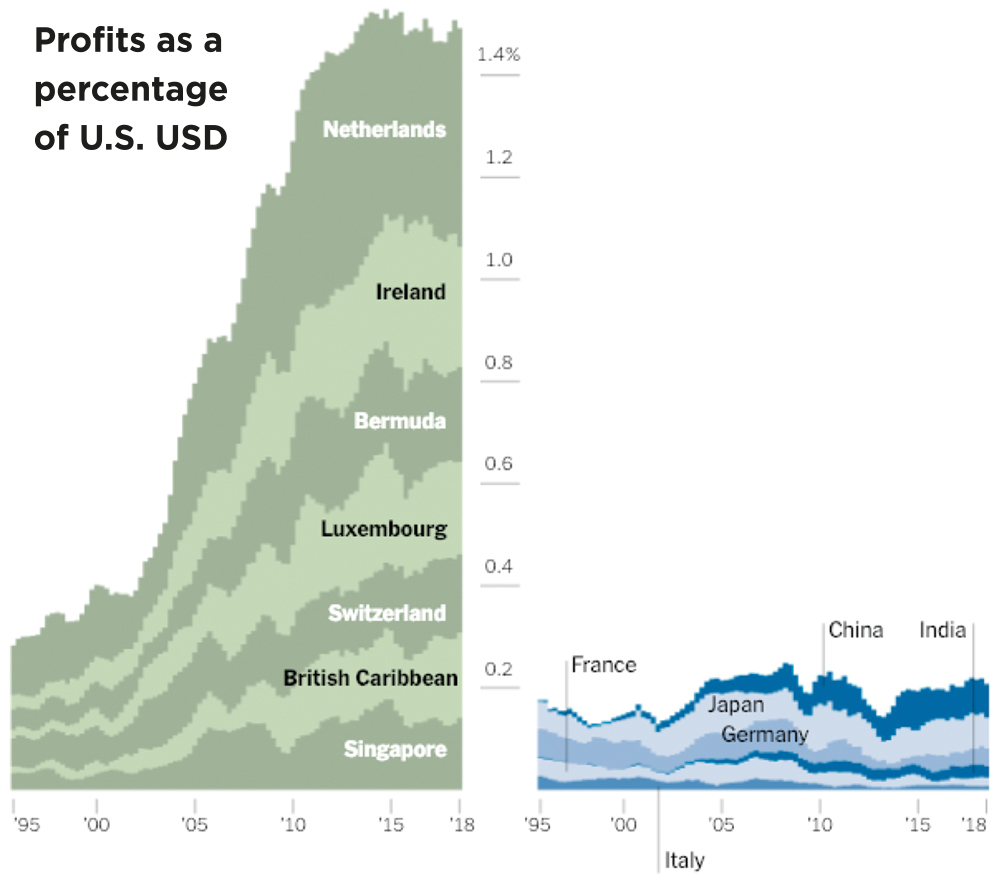

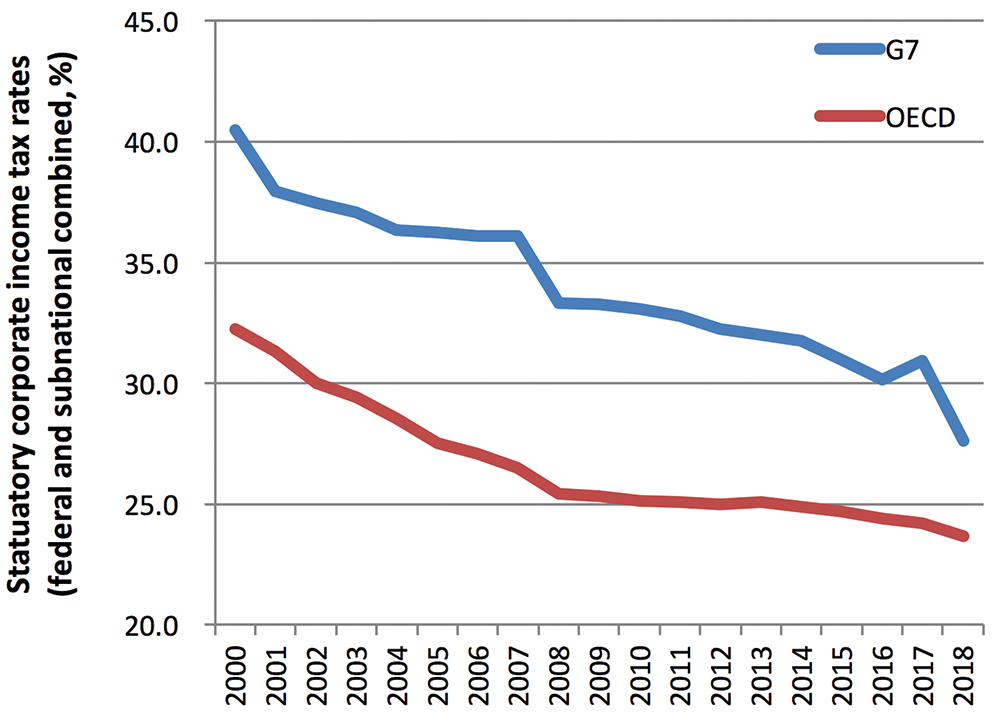

In the past, proponents of tax competition have underlined its positive effects on government efficiency, which were supposed to improve the provision of public services to respond to fleeting income. This argument generally does not hold for corporate taxation, since companies are much more mobile than citizens. As a result, we can observe a “race to the bottom” of corporate tax rates. Public choices are distorted in favor of the most mobile companies, with an increasingly important part of the tax burden born by the least mobile parts of a country’s population.

Source: OECD.Stat

The diagnosis of a problem changed in the last decade, not least in response to revelations about the extent of tax evasion or optimization by multinational companies. Moreover, the sovereign debt crisis in Europe brought fiscal capacity into sharp focus, either when countries with low levels of corporate taxation required international assistance to avoid sovereign default or when countries with high corporate tax rates saw their public budgets dwindle.

It comes as no surprise that the tax privileges for large multinational companies creates an outrage among ordinary citizens that do not have the same options to reduce their legal tax obligations. Fighting inequalities requires upholding social cohesion between the shareholders of companies, workers and consumers. Fair corporate taxation is crucial to achieving it.

Difficult agreement

This realization has pushed governments to seek multilateral solutions to stop the downward spiral of corporate taxation. Most centrally concerned is the European Union, whose integrated and non-discriminatory market is now being exploited by small member states using taxation as a means to attract foreign direct investment. Taxation as a key attribute of national sovereignty has always been a difficult issue for the member states and is bound by unanimity requirements until this day. As a result, proposals to accompany the single market with corporate tax harmonization were unsuccessful until the end of the first decade of the 2000. In 2016, the Juncker Commission – under pressure from the recent Lux Leaks scandal – proposed a two-step scheme f,or a Common Consolidated Corporate Tax Base that provides a single set of mandatory rules for corporate taxation, allowing national variation, but redistributing tax revenue among the member states where revenue was generated.

The adoption of these schemes in the Council is still pending, but one can expect opposition by the member states that stand to lose an important part of their tax revenue. The tensions were visible this spring, as the Council was unable to reach a consensus on the digital tax proposal that would have allowed taxing corporate giants such

as Google, Amazon or Facebook. Fearing effects on other aspects of their digitalized economies, Ireland and the Scandinavian countries rejected even a watered-down version of the proposal France and Germany had tried to push for. When it comes to corporate taxation, which goes to the heart of economic development models within Europe, the EU is unable to find a common stance. Not only does it fail to become a global rule marker, the current fragmentation is also bad for European member states, companies and citizens. Moreover, it impedes moving forward on integration in much needed areas, such as banking union or capital market integration, and thus hampers the single market. Without corporate tax harmonization, the European Union stands to lose on all fronts.

A more promising route might be the OECD’s Base Erosion and Profit Sharing (BEPS) initiative launched by the G20 in Kyoto in 2016. By trying to improve the coherence of international tax rules, enforcing information sharing and closing loopholes for tax avoidance, BEPS counts 125 voluntary member countries today from both the OECD and the developing world. With minimal standards against harmful tax practices and tax treaty abuse, country-by-country reporting and mutual agreement procedures, BEPS paves the ground for coordination of corporate tax policies in a more transparent way.

The effectiveness of such coordination is already visible in the area of offshore accounts. Through the Automatic Exchange of Information initiative of the OECD, tax information is now transferred through 4500 bilateral agreements. As a result of this sea-change, bank deposits by individuals and companies in international financial centers has dropped by 34% over the past ten years, which represents 489 billions euros, and led to an additional tax revenue of 95 billion euros worldwide.

As tax coordination and information-sharing within the OECD advances, countries and multinational companies are getting used to a new environment of global tax rules that will impact foreign investment strategies and define the rules for taxing the digital economy. This paved the way for a rare moment of consensus among the G20 this June to endorse a minimum tax rate for big tech companies and a framework on how taxes should be calculated, despite earlier concerns from the United States that the Franco-British proposal targeted in particular US companies. With the ambition to publish a work plan for implementation by 2020, the OECD has emerged as the most central coordination sight in global tax competition.

G7 leadership needed

The recent OECD agreements and Japan’s decisive role in facilitating this agenda need to be saluted as one of the most promising paradigm changes in global tax governance that would go a far step in fighting inequalities. But everything now hinges on the actual steps undertaken to get there. All the benefits of a multilateral consensus can be dashed in the implementation process.

Source: New York Times, analysis of Bureau of Economic Analysis data by Brad Setser and Cole Frank