G7 Executive Talk Series

Branded Story / Mandala

Authored by: Bridget Vandenbosch

Cryptocurrency Mass Adoption Through Regulation

The introduction of bitcoin has taken one of technology’s most novel innovations and delivered to the world an entirely new method of data propagation and value transference. Blockchain is streamlining the way societies create, store and verify data and transactions. With the power to further globalization, blockchain adds new layers of data security, accuracy and speed, creating opportunities for new efficiencies across economies, businesses and industries.

While blockchain technology is relatively young, the possible implications for every business around the world are very real. However, the birthplace of this technology and the communities of adopters around it have obscured an already complex tool and resource. Though it has been nearly a decade since Bitcoins debut, the rate at which this space evolves has left a gap for regulators and lawmakers through no fault of their own.

As hundreds, if not thousands, of cryptocurrencies, tokens and digital assets appeared, it’s relative immaturity has created a chasm where opportunists, fraudsters and the naive often find themselves in uncomfortably close quarters.The recent exponential growth of the space has created a culture where internet jokes, ‘memes’ and horror stories have drowned out the redeeming qualities and created uncertainty for those observing who have yet to adopt.

This technology space shows no signs of slowing down, in order for adoption to take hold developers need to begin working with regulators to ensure that consumers are protected and that blockchain has a place in our society. As regulations becomes clear, cryptocurrencies, blockchain and tokens will be taken seriously around the world, but the burden should not fall to just the lawmakers.

As Bitcoin introduced blockchain by way of a payment medium and distributed ledger network, the space has evolved to encompass new forms of crowdfunding. From 2013 up until today, ICO (Initial Coin Offering) introduced a new method of funding blockchain based projects through the private and public offering of tokens – which is equivalent to a securities offering.

“The SEC implies most ICO’s are securities, and I tend to agree. Developers have been soliciting funding much the same as a corporation would. While we at Mandala wholly support crowdfunding, we are firm in our value that these activities must be conducted in accordance with the law,” said Anant Handa, Co-Founder and CSO of Mandala. “Earlier in the year, the SEC testified in a congressional hearing, noting that they believe every ICO constitutes a securities offering and yet none had registered. It’s a problem that we need to fix. We as industry leaders need to embrace our responsibilities in this wonderful technology space.”

Of late, the acronym ‘ICO’ has become synonymous with financial fraud and illicit activity in addition to being unregistered securities offerings. “A much more appropriate term would be Securities Token Offering or STO. That’s what has been going on in the cryptosphere,” according to Nate Flanders, Co-Founder and CEO of Mandala.

“Securities offerings are a funding or investment round that enables a business to raise capital for operations, special projects and many other business initiatives. Developers, totally unaware, have created a new method to fundraise through digital assets, a token. These tokens are usually based on Ethereum, and the problem we face is that they are unregistered securities offerings,” according to Anant Handa.

Project developers may have been ignorant to global securities laws in driving forward with their passion for blockchain and innovation. A lot of the projects that exist today have created real world tools and applications that could bring meaningful change across a wide a spectrum of industry. It would be a shame for innovation to stop and for the blockchain space to remain in limbo.

Without regulatory guidance, clear laws and certainty, consumers will remain hesitant and adoption will continue to lag.

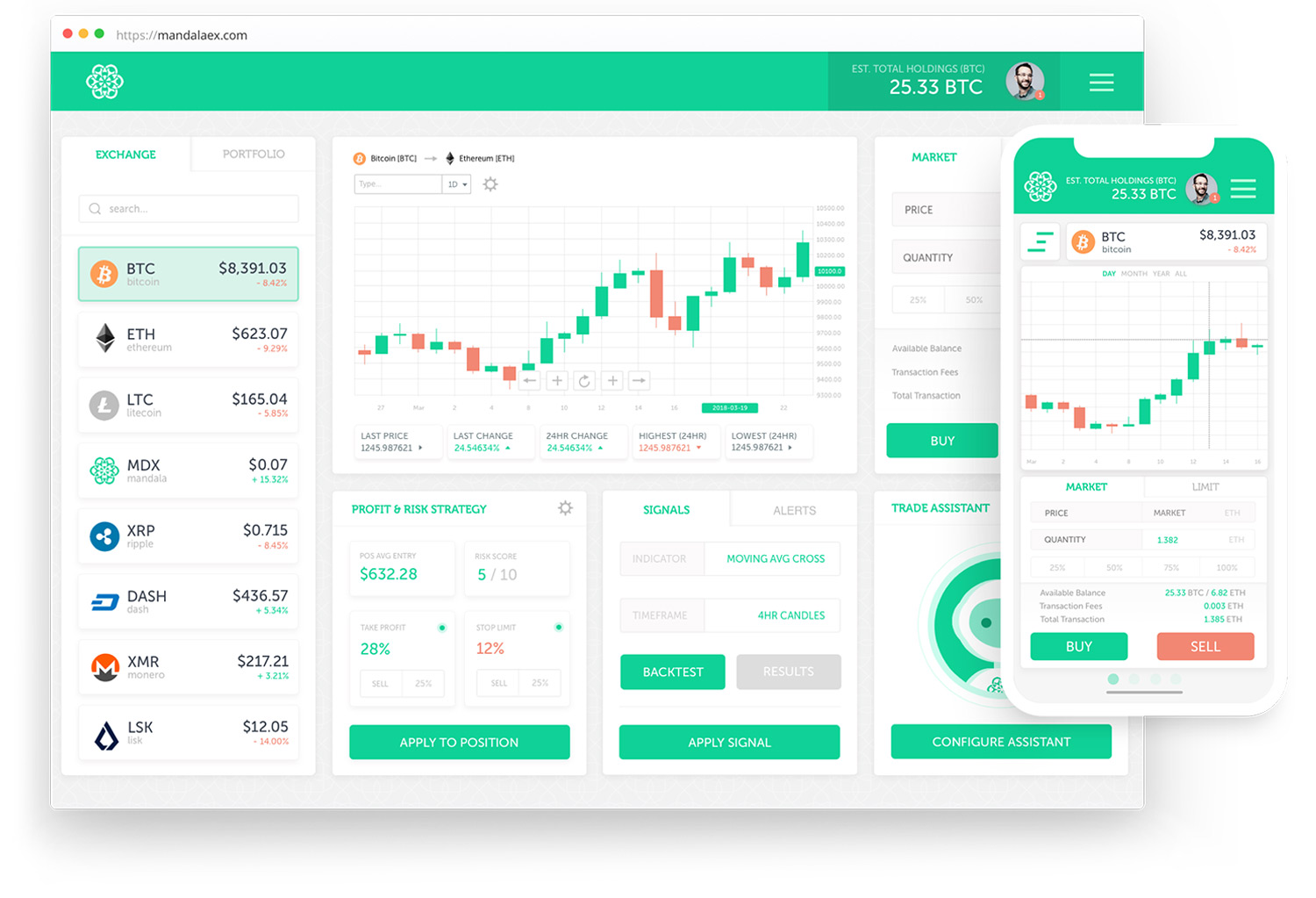

“Taking obscurity out of the space, making trading and investing in cryptocurrencies and digital assets not just accessible and safe, but bringing it to mainstreet; this is what drives us at Mandala,” said Nate Flanders. Mandala is a team of industry professionals dedicated to leading the charge across the digital asset space.

“Raising the standard of expectation means we aren’t beating around the bush. These are securities. This is people’s hard earned money. Consumers must be protected and industry leaders must engage with regulators and lawmakers. It is about ensuring the longevity of the industry and the safety of market participants,” said, Anant Handa, commenting on Mandala’s mandate to achieve full compliance.

Mandala strives to be an agent of change, creating a platform that users can feel confident in, knowing it will be there tomorrow, that their funds are safe and that the organization is accountable. Not shy, the leadership behind Mandala is ready to engage directly with regulators and the SEC (U.S. Securities & Exchange Commission). Plans already in place and filings ready to mail, Mandala will register as an Alternative Trading System (ATS) with the SEC and register or acquire a Broker-Dealer (BD) license. The organization is also seeking Money Transmitter Licenses (MTL) in as many states as possible.

“Mandala is a first of its kind exchange and platform. We introduce a functional token to our users and central to our mission is achieving full compliance. It is a primary objective,” said Anant Handa. “There has always been a risk that unregistered exchanges could be shut down with a legal notice and forced to halt trading. When it is people’s money on the line, that’s just not okay, and it isn’t the regulators fault, they have to protect consumers.”

In addition to the above licenses Mandala is filing for a Reg A+ offering, allowing their MDX token to flow back to the United States. The team behind Mandala is taking their mission seriously, doing it right, and delivering a unique experience and advantage to its user base through compliance.

“I’ve been in this space for a few years, mostly as a market participant, and let me just say, if we want to see the adoption spread beyond current demographics, the path is through regulation. It’s needed, we have people committing fraud left and right, others entirely naive to what they are doing – clarity, certainty, that’s how we grow the space into a trillion dollar market,” according to Anant Handa. “I think what makes us unique is that we were market participants, we’ve seen it all – that’s why Anant and I are a driving force behind the next phase of blockchain implementation around the world,” added Nate Flanders.

![]() The adoption of blockchain technologies around the world takes an industry leader willing to embrace regulation as their duty and responsibility.

The adoption of blockchain technologies around the world takes an industry leader willing to embrace regulation as their duty and responsibility.![]()

Organizations like Mandala, and industry leaders like Anant Handa and Nate Flanders are firm in their values of adoption, legal compliance and reasonable regulation throughout the blockchain space, known today as the wild west. “Connecting the universe through blockchain is our motto – to us it means driving accessibility for novices, veteran, institutions and retail investors. As we accomplish this through regulation, the opportunities for developers in the space are limitless. With regulatory certainty, innovation on blockchain technology would only accelerate, benefiting society globally,” concluded Anant Handa.

One of the greatest technological advancements since the internet, blockchain is driving connectivity and innovation on a scale the world has never seen. While regulators and lawmakers absolutely have to continue to drive forward with their mandates of consumer protection, industry leaders and developers must meet them in the middle. To ensure that regulation is done reasonably and thoughtfully is in the best interest of the user base, adopters and developers.

Blockchain, cryptocurrency and Security Token Offerings will find their place in the technology and investment world. The current market demographic is a fraction of what it could be and fostering adoption means taking the space out of obscurity, out of the wild west phase and into a new frontier. Having the foresight and seizing the opportunity to participate in regulatory development will foster adoption and ensure a lasting place in the blockchain history books.

Anant is a co-founder of Mandala, a next generation cryptocurrency exchange and platform. Anant Handa is a serial entrepreneur and seasoned chief executive with over 10 years of experience. He has cultivated over $100M in revenue across multiple ventures throughout his career. He is a strategic investor, mentor and advisor to multiple start-ups.He has accomplished this by maintaining awareness of both the external and internal competitive landscape, opportunities for expansion, customers, market, new industry developments and standards. Anant has a degree in Information Technology and Software Systems Engineering from Colorado Technical University and currently lives in Chicago with his family.

Nate Flanders has owned, operated, and scaled multiple successful companies that range from online marketing agencies, software development & sales, the gambling industry, the cell phone repair retail & wholesale industry, and most recently the blockchain industry. Most recently, Nate has Co-Founded a second generation digital asset exchange within the cryptocurrency industry, Mandala. Mandala aims to disrupt the current crypto exchange market and become one of the first cryptocurreny exchanges to become fully compliant with the SEC.