G20 Executive Talk Series

Sustainable Growth

THOUGHT LEADERSHIP

Sustainable Growth

THOUGHT LEADERSHIP

Authored by: Gianluca Riccio

From the Low Growth Trap to Sustainable Growth:

The case for a coordinated G20 policy approach

Business at OECD highlights the risk of missing out on SME potential if the G20 fails to address the unintended consequences of regulation, alongside access to finance and cyber risks.

In Brisbane back in 2014 G20 leaders committed to reforms to raise GDP by 2% by 2018. Since then implementation has been sorely lacking, in fact governments have often been going in different directions – for example, research from the OECD, WTO and UNCTAD, shows that 145 new trade-restrictive measures were applied by G20 countries between October 2015 and May 2016. The result is that when global leaders meet again in Hamburg in July 2017, they face a decidedly mixed economic picture.

Business as OECD is clear that to meet the G20’s growth target we need the rapid and internationally consistent implementation of well targeted policies that encourage private sector led growth. This is particularly true to unlock the potential of small and medium-sized enterprises (SMEs), whose participation in global value chains (GVCs) not only supports growth in our economies, but also enhances their own productivity and innovative potential. In fact, GVCs offer an ideal platform from which to evaluate G20 policies and assess their end-to-end impacts, hence identifying unintended consequences. They represent a nexus between investment, innovation and trade and improving them offers a high potential to boost GDP, increase employment, and improve working conditions and long-term industrial development.

The G20 must translate broad-based growth sentiment into action on the ground encouraging governments and policymakers to expand their focus from being the guardians of financial stability towards enablers of growth and investment. Indeed, the need to avoid parochialism is more important than ever in the current economic and political climate. In turn, the private sector must offer solutions and take more ownership of actions as well.

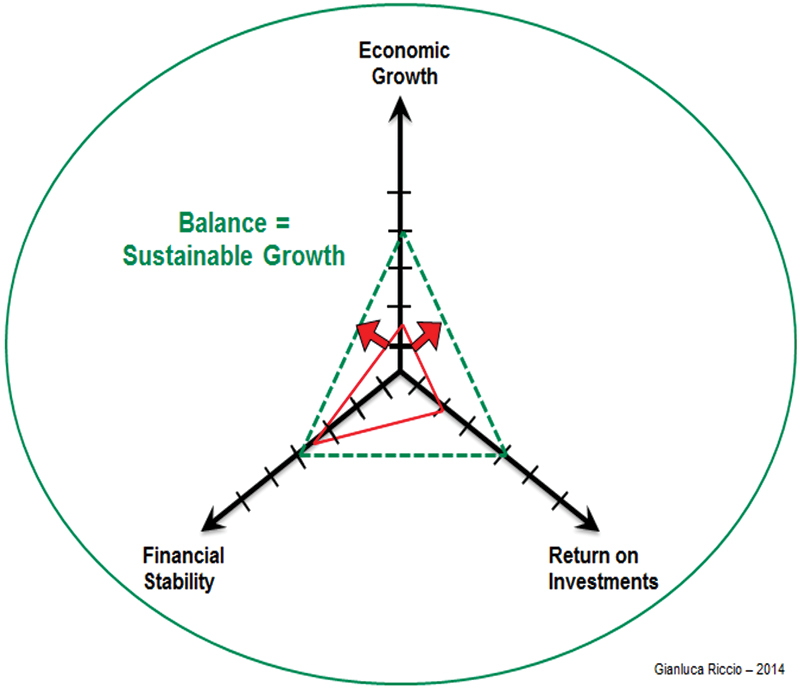

Identifying what governments should do, and how, to support SME access to GVCs was the focus of a senior level roundtable held at the OECD in March 2017, as a joint initiative between Business at OECD and the German B20. It focused on the recommendations needed to achieve a sustainable balance among financial stability, inclusive growth, and returns on investment by joining the dots across all the relevant policy areas.

A conceptual framework developed in 20141 and updated to capture the G20 priorities in 20172

Building Resilience: The G20 has set itself the task of growing economies and strengthening stability of their financial architecture. Both are needed, but it is their balance that ensures resilience. Focussing only on financial stability without proportionate economic growth policies, may result in safe but stagnating economies.

Improving Sustainability: Growth is not only important in itself; the type and quality of growth also matters. Good quality economic growth is achieved through longer-term investments (e.g. digital, infrastructure, global health, climate and energy), which can only be obtained by ensuring proportionate return on such investments.

Assuming Responsibility: In an increasingly interconnected world, such return on investments need to be balanced with the required stability (not just financial) of the affected markets, as impacts go beyond the investments’ immediate boundaries. Hence tackling the causes of displacement, fighting anti-corruption and terrorism, and targeting agriculture/food security.

1The 3-axis (Economic Growth, Financial Stability & Return on Investment) equilibrium concept was developed by Gianluca Riccio in 2013 as part of the BIAC work on unintended consequences of Financial Regulation – BIAC (2014) “The case for a more coordinated approach to financial regulation: A BIAC discussion paper”

2G20 (2017), Priorities of the 2017 G20 Summit.

WE DEVELOPED THREE OVERARCHING RECOMMENDATIONS:

RECOMMENDATION 1: Improve coordination and consultation in implementation, and better assess the impact of regulation to minimize cross-border and cross-policy inconsistencies, and thereby minimize unintended consequences.

Within the framework of reinforcing financial stability, economic growth, and return on investments there is a critical need for broader and independent (from those bodies setting policy) economic impact assessments. This is needed to determine the cumulative effects of G20 policies and other regulatory initiatives – both domestically and across borders.

Similarly, the implementation phase of financial and tax regulations would be significantly improved by introducing an international, principles-based implementation process, and a more formal mechanism for continuous and systematic cross-border dialogue between national regulators. Minimising inconsistencies by applying these measures would ensure reduced compliance costs, both direct and indirect, for SMEs and ensure alignment between regulation 1.0 and 2.0.

RECOMMENDATION 2: Raise SME access to finance, both debt and equity, and skills through an integrated financing approach, fostering timely payments, and better leveraging opportunities offered by digital, trade finance and green finance.

There is a need for all actors to take action, rather than only focusing on measures for governments. The growing willingness of private and public stakeholders to undertake their own distinct voluntary initiatives needs to be encouraged. G20 policy approaches should enable, and not hinder, private sector-led initiatives. This does not mean a change of roles, but rather better leveraging successful or promising initiatives and sharing best practice.

A point in case is given by long-terms investments: it is not sufficient to provide public funding, it is critical that funding is available in a regulatory environment that supports the long-term nature of such investments, e.g. regulations that support rather than curtail longer dated investment or equity financing.

RECOMMENDATION 3: Maximize access to data and sharing of information through digital platforms for a coordinated response to global challenges, including cyber security.

Leveraging the use of digital technologies and information exchange enhances the flow of financing, skills, and investment throughout GVCs – this is no longer an opportunity, but a “must” requirement in today’s world. However, there are material pitfalls to doing so, the most prominent being cyber security risk. These can only be managed through coordinated efforts and we encourage the G20 to keep its emphasis on data coordination and harmonization. The G20 Action Plan on SME Financing, which provides a framework to facilitate dialogue between the relevant international fora and the G20 work stream, is particularly important in this regard.

These three recommendations offer medium-term guidance to G20 leaders as they look to improve global economic performance by supporting SME access to GVCs. To see real progresses continuity between G20 Presidencies is paramount. The work of past taskforces must be reviewed and adequate forward momentum across Presidencies must be ensured. As we highlighted to the Turkish, Chinese and now German presidencies, policy consistency is a necessity for achieving a sustainable balance between financial stability, economic growth, and return on investment.

Gianluca Riccio, CFA is Vice Chair of the Business at OECD Finance Task Force,

Member of the B20 taskforce on Financing Growth & infrastructure, and member of the B20 Cross-thematic working group on SMEs.