GLOBAL POLICY LAB

At the same time, investments through external borrowing should not undermine debt sustainability or leave a big footprint in environmental and ecological systems. Achieving all these not quite congruous objectives is the only way to secure buy-in from the people for these actions. This makes it all the more important to identify a fresh approach to development based on our collective experiences. In this context, MDBs should ramp up their efforts to be more responsive, innovative, efficient and cost-effective, and they have to break away from outdated modus operandi.

We in the Asian Infrastructure Investment Bank (AIIB) are trying to come up with such a new approach. While AIIB resembles most of its peers in terms of governance structure, one distinctive feature is its non-resident Board of Directors, which guides, directs and oversees the management. The board approves policies and strategies, and delegates authority to the management and holds it accountable under the Board-approved Accountability Framework. This governance structure and its function are not just cost-effective, which is certainly important for any institution, but more crucially they demarcate a clear-cut division of responsibility between the board and management.

The role of the board is enhanced rather than reduced since the directors can focus on more strategic tasks. Starting in January 1, 2019 AIIB’s board began delegating project approval responsibility to the management on a principles-based approach. While this appears to be an innovative feature for a multilateral development bank, it is common practice in the private sector.

Forward-thinking governance practices tell us clear accountability placed on individuals leads to better outcomes. As AIIB embeds this modern practice into its organization, we hope there will be lessons learned which will be of interest to our peers in the development world.

As a young organization, we have the ability to test new operating models to find efficient ways of delivering development outcomes. If we identify ones that work well, we intend to share what we have learned with our development partners who have so generously shared their growth journeys with us.

Another new approach we have adopted is to create Client Relations and Programming (CRP) Office. CRP’s role is to conduct on-going dialogue and program-based engagement with our member-clients. To ensure orderly, rational and systematic business development, CRP conducts country program consultations without building large country-based offices. Our belief is we can still develop deep relationships and a strong project pipeline with a mobile and specialized team while keeping operational costs down. The CRP is off to a strong start and we look forward to sharing what we learn with the development community.

There is an African proverb that says, “if you want to go fast, go alone. If you want to go far, go with others.” When examining the task ahead of us, there is no question we have far to go.

As described in the Report of the G20 Eminent Persons Group on Global Financial Governance, the international monetary and financial system lacks coherence and does not “work as a system.” There are global and regional players, in some cases working as partners and other cases working as competitors for the same projects.

According to the Asian Development Bank, multilateral development banks only make up 2.5% of funding in developing Asia. This compared to the USD 1.7 trillion needed every year in Asia (from 2016-2030) means we have to make our dollars work harder. One way to amplify our investments is through better cooperation amongst ourselves, and the other is by mobilizing private capital.

At the recent heads of MDBs meeting during the IMF and World Bank Annual Meetings, consensus was reached that MDBs should not come to the table as competitors but to always support each other as partners. Firm adherence to this commitment is testament to our professional integrity. We work for the people. This is our privilege and we must do everything in our power to achieve the goals set before us.

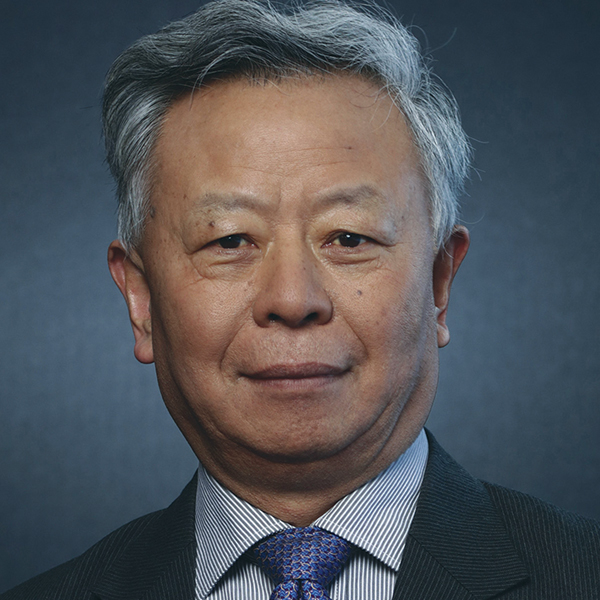

He joined the Ministry of Finance in 1980, where he served as Director General and Assistant Minister before becoming Vice Minister in 1998. He was also a Member of the State Monetary Policy Committee. Earlier in his career, he served as Alternate Executive Director for China at the World Bank and at the Global Environment Facility as well as Alternate Governor for China at ADB. Jin holds a master’s degree in English Literature from Beijing Institute of Foreign Languages (now Beijing Foreign Studies University). He was also a Hubert Humphrey Fellow in the Economics Graduate Program at Boston University from 1987 to 1988.